B2B & B2C concepts

06/03/2019

Employee motivation: art or science?

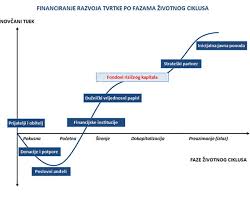

18/03/2019One of the most important items when starting a new business is precisely the financial component of the entire project. So raising money for your own business is often one of the most difficult tasks in the process, unless you are already financially stable enough. At the beginning of the business, you have to count on three groups of costs. The first group includes costs related to maintaining a positive cash flow, such as raw materials, salaries, employee training and marketing. The second group includes capital investments, which includes equipment, land and real estate. The third group refers to long-term product development.

The biggest advantage of startup companies is that this type of business project attracts potential investors and they are more stable than established companies. This means that they have greater development potential with minimal investments in the previously listed cost groups, i.e. employees, real estate and capital. Here, it is important to note the disadvantages of this type of business project, which are primarily related to the high risk of business, which specifically means that among the liquidated companies, the statistically largest number are precisely startup companies. This is because such companies are characterized by lower initial investment amounts, higher risks and a higher potential return on investment.

In the following, we will clarify some of the alternative sources of funding for startups , which differ from the classic division of sources of funding (according to the term of availability of the source, according to the origin of the source and according to the ownership of the source), namely crowdfunding and risk capital.

Crowdfunding . Crowdfunding (Croatian: “collective financing”) is a method of collecting money for financing projects and operations by a large number of people. In crowdfunding, the necessary money is collected from many people. This is mostly done through cross-network platforms. Crowdfunding is most often used by newly established trading companies or companies to obtain additional funds. In addition to obtaining money in this way, the final collector creates a community around the offer of the products it produces or the goods and services it sells. With crowdfunding, the market situation is assessed, because the collector, as well as the final user, gets an insight into the market and access to new clients. Crowdfunding, as one of the options, is still considered an innovative form of financing, not only in Croatia but also in Europe in general. It is not only a way of collecting financial resources. It is a marketing and social concept through which individuals, teams, associations, entrepreneurs and other interested parties can present their ideas and achieve success. Crowdfunding is changing the financial industry on several levels. The first is that it enables the validation of the idea itself before the final product reaches the market, the second is that it enables access to capital without the additional collateral required by the traditional financial sector. It is unlikely that the bank will give you a loan to start a business without taking out a mortgage on some real estate and/or machinery. The third important thing is risk dispersion. The initiator of the campaign, who has worked out his business plan well, knows how much money he needs to start the business, and if he does not collect all the necessary money, he will not even embark on a business venture. On the other hand, donors contribute relatively small amounts that they can afford to lose. The last thing is the marketing dimension, which is crucial for a successful campaign. Not only do you collect money for your business with crowdfunding, but you also do advertising for it. You can read why people help each other financially, what are all the crowdfunding platforms and how to prepare a project for such a campaign in the Crowdfunding Guide prepared by Hrvoje Hafner and the association SMART from Rijeka.

Risk capital . Venture capital is a type of investment by financial investors in the share capital of companies that are not listed on the stock exchange and have the potential to achieve high growth rates over a period of 3-7 years. These are investments that transform, create new value and imply an active investment strategy of venture capital fund management companies. An active management strategy is reflected in participation in the realization of business growth ambitions through financing and the provision of strategic advice and information at key moments in the company’s development. The main goal of venture capital fund management companies is to find companies that have growth potential with the aim of combining capital, talent and strategy to strengthen the company in the long term and increase its value. Venture capital funds are suitable for financing certain projects or companies when they are in the phase of intensive growth or consolidation in the market. At that moment, there is a strong need for financial resources that can accompany such intensive growth and at the same time leave enough space for entrepreneurship and an unencumbered cash flow. Most venture capital funds are established with a term of 10 years, where it is common to extend the term up to two years to allow additional time to exit the investment if necessary. The investment cycle of venture capital funds is usually 3 to 5 years, during which the focus is on management with the aim of increasing the investment value for the benefit of all co-owners in the companies in the portfolio. Venture capital brings not only financial resources, but also certain management skills, and it has been shown to introduce best practices and standards in the management of portfolio companies, and on average, portfolio companies achieve higher growth rates than their competitors. Venture capital funds have a long-term investment horizon, are involved in the business for the entire duration of the investment and usually do not require guarantees for the return of invested funds and returns. The investment of venture capital funds does not burden the cash flow since it does not require interest or dividends on its investment, but is “charged” when selling shares in the company and if the business was successful, it achieves a certain return on the invested funds. This is precisely why the interests of the other co-owners and the fund are aligned and focused on increasing the value of the company. Venture capital shares the risk of failure and the reward for success with other co-owners in the company until the moment of selling its share. The sale of shares can be realized through sale to management/co-owners, sale to a strategic or financial investor or listing on the stock exchange. Most often, the venture capital fund reserves the right to decide when to sell its own part or the entire company.

It is in Croatia in 2018. In 2010, the first fund for equity capital investment that will benefit from the European Structural and Investment Funds (ESIF) was presented. This financial product of EUR 35 million from the Operational Program “Competitiveness and Cohesion 2014-2020” will be aimed at the earlier stages of investment in order to support the development of the Croatian startup market. It is a fund whose funds will influence the capital empowerment of entrepreneurs, which for many at this moment is crucial for further business development. Capital from this fund is primarily directed to sectors with high growth potential, i.e. to innovative companies in the initial phase of development and companies in a more advanced phase of development that have not yet conducted a public offering of shares.